Should I Go to College?

Going to college may have been an easy choice for your parents. Twenty years ago, career paths were more straightforward, and a bachelor’s degree was almost guaranteed to mark you as the cream of the crop. Not only that, but when a year of college cost barely more than a new iMac, it was much easier to pay for if you simply had some savings or even a part-time job. In a world like that, why wouldn’t you go to college?

But the world has changed.

Bachelor’s degrees are still respected, but they’re also flooding the marketplace. This means they’re not the guaranteed “in” they once were. At the same time, costs have risen so much that a year of school today costs almost five iMacs. And that’s not even counting books and housing fees.

Going to college is no longer a no-brainer.

So before you take out a $30,000 loan for something you may not even need, ask yourself the hard question: is a college degree necessary for the career you want?

type: entry-hyperlink id: IKKV7YIpvxntqHdLd2tXfIf you want to go into law, engineering, the medical field, or similarly specialized fields, there’s no question. You 100% need a degree. Stop questioning your decision, and instead, focus on figuring out the best (and most affordable) way to earn it.

But what if you’re considering work as a missionary, welder, graphic designer, or any of the various vocations that may not require a college education? It’s possible you could benefit more from earning a specialized certification tailored directly to your chosen career, letting you start working sooner and with a much smaller financial investment.

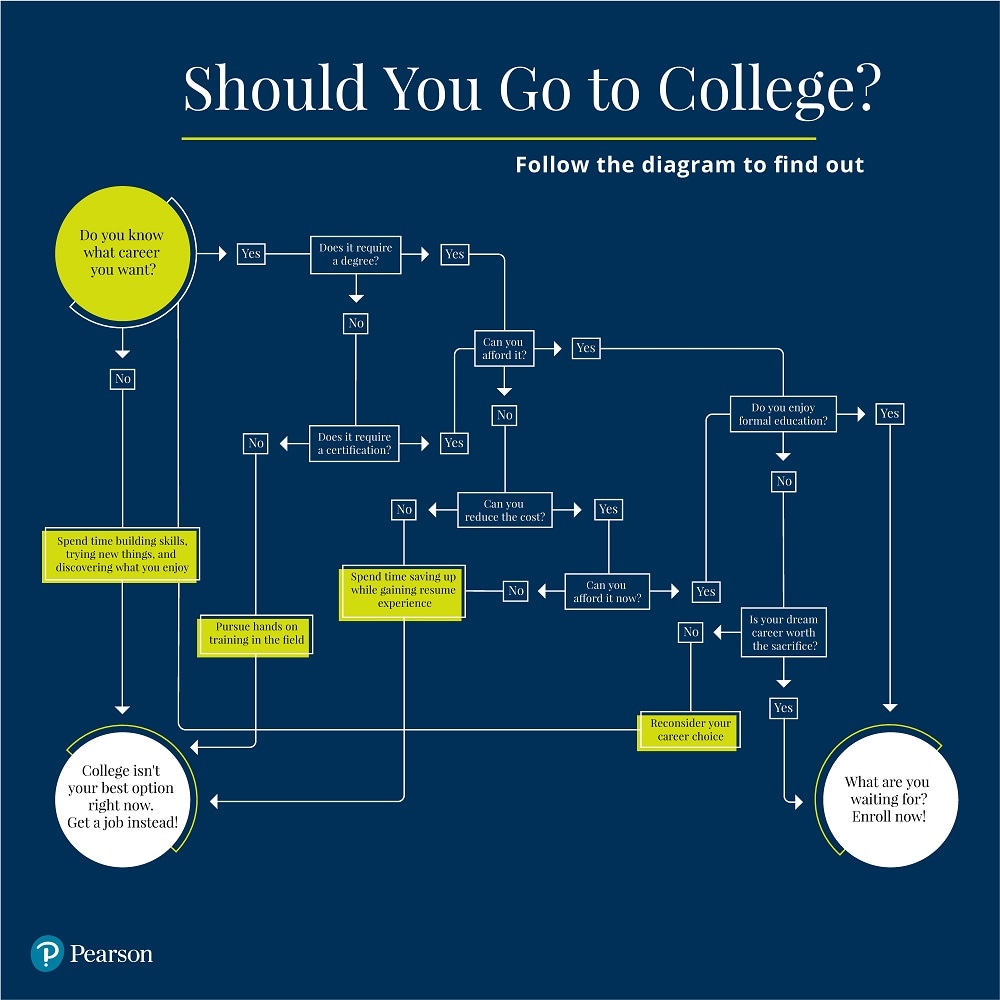

Obviously, choosing whether or not to go school won’t necessarily be as simple as this graphic describes, and there’s often not a clear-cut “right” or “wrong” choice. But we made this graphic simple for a reason. When it comes to deciding whether college is for you, you really just need to answer three important questions which we’ll discuss later in this post. Everything else will fall into place based on your answers to them.

The Benefits of College

The benefits of getting a college degree are still numerous. For example, the Federal Reserve Bank of New York reports that the average college graduate earns $78,000 per year, against an average of $45,000 per year for individuals with only a high school diploma. Other benefits include the following:

College graduates have greater access to employer-offered benefits, paid time off, and employer-sponsored retirement savings plans, such as 401(k) contribution matching. The Association of Public Land-Grant Universities reports that bachelor’s degree holders are 47% more likely to have health insurance through their jobs than individuals who hold only a high school diploma.

Data from the U.S. Bureau of Labor and Statistics has consistently shown that college graduates have lower unemployment rates than individuals who did not go to college.

College graduates have more career options. For example, someone who majors in psychology can go on to become a clinical psychologist. Or, if they don’t want to practice psychology, they can pursue jobs in sales, marketing, education, and countless other fields. Although most employers require that candidates have a college degree, unless the job is degree-specific (e.g., mechanical engineer), their majors are often irrelevant.

The Challenges of College

Although going to college has numerous pros, you should also weigh the cons. For example, tuition fees have increased by more than 25% in the past 10 years. Other cons include:

Student loan debt can be difficult to manage. The average college debt for the class of 2019, including federal and private loans, was recorded at $29,900. As such, individuals who are weighing college should research student aid resources and college budgeting resources and plan accordingly.

The Federal Reserve Bank of New York reports that as of June 2020, 39% of recent graduates and 32.7% of college graduates were underemployed and working in jobs that did not require a college degree.

The increased rate at which students are earning college degrees has diluted their value.

The 3 Questions to Ask When Making a College Decision

Making the decision to go to college requires thought and reflection. Here are some important questions to ask yourself before you go.

1. Do I know what career I want?

Going to college means making a significant investment in your future. No matter how you slice it, you’ll be spending no small amount of time, money, effort, and focus to gain an education.

So you better be sure you actually need the schooling before making the investment.

Are you interested in being a masseuse, airline pilot, entrepreneur, electrician, or athlete? None of these jobs require a bachelor’s degree. Some require an associate degree. Some require non-college education. Some, simply on-the-job training.

Every career requires a unique form of preparation. So determine what career you’re aiming for first and don’t bother wasting time and money on training that won’t benefit it. Choose the training that’s right for you.

2. Can I afford college?

I realize that student loans are the norm these days, but they’re also ruining people’s lives.

The average national student debt is almost $30,000. Among student loan borrowers, 20% said their loans delayed their ability to get married, 30% said their loans prevented them from starting a family, and 50% said they couldn’t buy a home because of their student loans.

Life is so much bigger than college or even your career. And if you hastily choose to go to college on borrowed money, you may find yourself regretting that decision in 20 years when you realize those loans are preventing you from living the life you went to college to build in the first place.

Fortunately, debt isn’t your only option.

It’s a rare day indeed when a student pays the exact sticker price for their education. Often, if you’re not savvy, you’ll end up spending a whole lot more. But if you are savvy, you can spend a whole lot less. We should know—that’s what we do all the time! Using a variety of methods, such as affordable transfer credit and in-depth degree planning, Pearson Accelerated Pathways’ admissions advisors help students cut their degree costs in half and graduate debt free.

Making college affordable is possible—it just takes some effort.

So, before giving in to a loan or giving up on college altogether, take time to really explore your options and do what you can to reduce your costs. (And maybe find out if you’re a candidate for Accelerated Pathways.)

3. Do I enjoy formal education?

Think about it: you’re signing up to spend the next four years (at least) in the classroom. If that sounds like hell, don’t do it.

Not only would you be torturing yourself, but it’s likely your sheer dislike for what you’re doing would cause your performance to struggle. Your personal life would suffer, and you’d likely end up dropping out anyway—which means throwing away a ton of time and money.

If you hate school, but you’re willing to make the sacrifice to get the job you want, then more power to you! But in most cases, if formal education isn’t for you, the jobs that follow aren’t either. If you dislike formal education, we recommend you reconsider your career choice—maybe do some job shadowing, volunteer, or talk to professionals in the field—to ensure that choice is really for you before jumping into college.

How to Figure Out a Career Path

Whether or not you should go to college depends entirely on what you want to do and how you can best prepare for that future. But what if you still don’t know what you want to do? If you’re still trying to decide on a career path, consider the following steps:

Get a job.

Start earning basic work experience in a job that doesn’t require a degree. You’ll get both a head start on your resume and a good perspective of the real world (outside of school).

Get an internship.

Find an internship or volunteer in a field you’re interested in. You’ll be able to learn about that field firsthand and get some hands-on experience for your resume too!

Take affordable courses.

If you’re leaning toward college, there’s no harm in getting started now—as long as you’re not isolating yourself from the world or going into debt to pay for it. Try taking affordable courses you know will transfer into your chosen degree to learn what subject areas you may want to pursue further.

Ask a professional.

Find someone working a job you think you may want and strike up a conversation! Ask what they like and don’t like about their job, and hear their own opinions on what it takes to “make it.”

Seek counsel or mentorship.

Sometimes it’s worth talking to someone who has seen a lot more of the world, even if they’re not working in your field of choice. They might have the perspective you need to develop a wise plan for moving forward. (Your parents are a great choice for this; however, they may be too emotionally invested in your decisions to provide the clarity you need. In addition, consider talking to a close adult friend, academic counselor, or church leader.)

Or consider working with a career counselor. Career counselors are an invaluable resource for individuals who are still trying to map out their employment and career goals. You can also take a free career test. Career tests consist of a variety of questions designed to home in on your interests and personality traits, which are used to match you with possible career choices.

Start learning on your own.

You don’t need to be enrolled in college to learn. Find online resources like Khan Academy, Lynda, Codecademy, Udemy, or another, and just start! Use this time to assess what career and lifestyle you want, as well as the best way to achieve it.

Try choosing at least two ideas from this list and pursuing them in tandem. For example, if you’re thinking of becoming a veterinarian, volunteer at a local vet’s office while pursuing a flexible, affordable education.

I know that one quick blog post isn’t enough to help you finalize a decision this big. No amount of reading other people’s opinions for and against college will truly help you make this decision. But hopefully this has at least helped you get started.

Fortunately, as long as you take time to think through your options and begin broadening your life experiences, you’re headed in the right direction. Just consider carefully and make the wisest choice you can with the information you have.