Is College Worth the Cost?

Getting a bachelor’s degree is a great idea… but it’s an expensive one. It’s hard to know how much debt you might incur in the process or how long it could take to pay back.

Bottom line… is it worth it? Does the cost of college pay off in the end?

We decided to look at three possible options:

Going to college on loans

Skipping college altogether

Working while taking online courses

How much would each of these choices actually cost you? And how can each decision impact your finances, career and life?

Check out what we found!

1. Going to college on loans

Let’s say you go off to college, graduate and find a decent job. You're making good money and doing pretty well for yourself. That's the dream, right?

But what did college actually cost you? And how will it affect your finances after graduation?

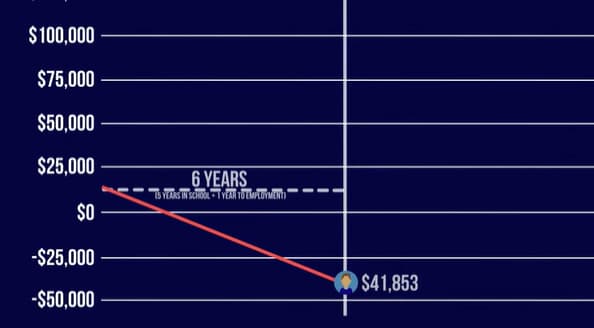

By the time you graduate and get a job, you'll have roughly $41,000 in student loans. That's assuming you pay the average tuition costs, get an amazing federal loan package with interest rates at 3.76%, get $30,000 in grants and scholarships and you've saved $16,000 before even starting college.

But what about not getting a degree?

2. Skipping college altogether

What if you decided to get a job right out of high school—maybe as a server? Let's assume you're one of the 25% of servers in Houston, Texas who makes $39,000 a year.

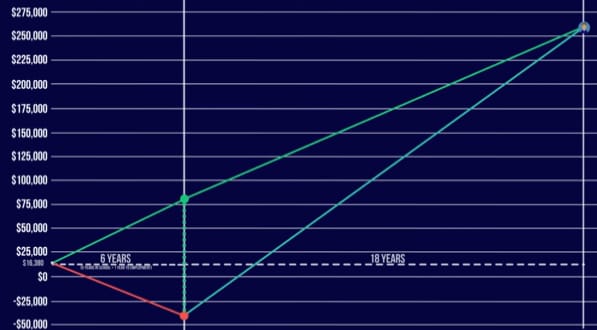

After taxes and cost of living, you would have made roughly $81,000 as a server instead of racking up $41,000 in student loan debt. That means you missed out on a whopping $123,000 in opportunity cost.

So, how long will it take for your degree to recover $123,000 in opportunity cost?

Let's go back to the first scenario to compare.

Let’s say you graduate college on loans and get a great entry level marketing job making $51,000 a year. Your degree is already starting to pay off. Except, all other things being equal, you'd be over 40 years old before you recover the full $123,000 opportunity cost from not working as a server.

So, 20 years of debt just to get a better job, and you actually paid $60,000 for the original $41,000 loan. That's over $18,000 just in interest! And don’t forget you already paid the $16,000 dollars you had in savings.

The stark reality is that student loans are way more expensive than lenders and colleges want you to believe.

But what if you could go to college without loans?

3. Working while taking online courses

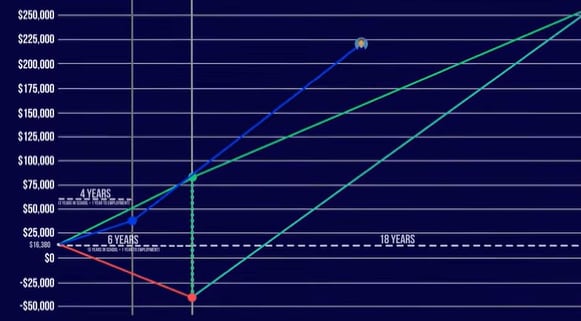

Let's go back to the example of working as a server. You're making $39,000 a year, but then you also decide to make a lot of sacrifices. Maybe you live with your parents and take online college courses around your shifts at work.

Now, it would still cost money to get your degree. But since you wouldn't be living on campus or paying high tuition fees, you wouldn't have to take out any student loans. You'd just be paying for your courses as you go.

All your hard work would pay off because, after graduation, you get that same great entry-level marketing job making $51,000 a year. The difference is, now you don't have to pay off student loans or spend decades recovering your opportunity cost.

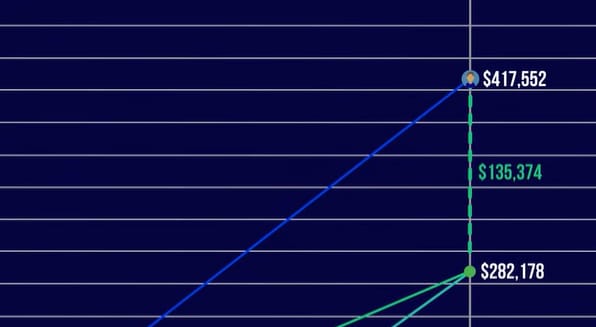

So compared to where you’d end up in scenario 1 or 2, you’d have $135,000 extra! That's a lot of additional money by the time you’re 40 years old. Almost enough for a house in some parts of the country.

Which option should you choose?

Here's the thing: education is important. But, 20 years is a long time for it to pay off and missing out on thousands in earnings because you’re paying off debt is ridiculous!

So, before taking out a ton of student loans, you should evaluate your options and look for ways to attend college without going into debt.

That’s why we started Accelerated Pathways.

We believe college shouldn’t be a debt sentence. Our goal is to help students stuck in the debt zone graduate from college—and graduate debt-free.

If you’re willing to use the power of online education to avoid the student loan trap, we’re here for you.

Check out our easy degree pricing!