16 Highest Paying Majors (That Aren’t STEM)

We get it—growing up is expensive. Groceries, gas, college classes… it all adds up. And you don’t want to barely get by, you want to thrive! Moving out of your parent’s house, getting a car that doesn’t break down every other week, and being able to afford a night out with friends are all admirable goals. Goals that require a reasonably-sized paycheck.

If you aim to earn a decent living, your degree choice matters—and not every bachelor’s degree has the same financial future in store.

But you also want to work in a field that interests you. From a quick Google search, you’ll find that a majority of the higher paying jobs are STEM (science, technology, engineering, and math), and require degrees in those respective fields. That’s great… for people who enjoy science, technology, engineering, and math. But what about the rest of us? Is there any hope for us?

Absolutely!

Being uninterested in STEM doesn’t mean you’re doomed to be a starving artist. Despite common belief, you can work in the arts, education, or social sciences and earn an above-average salary.

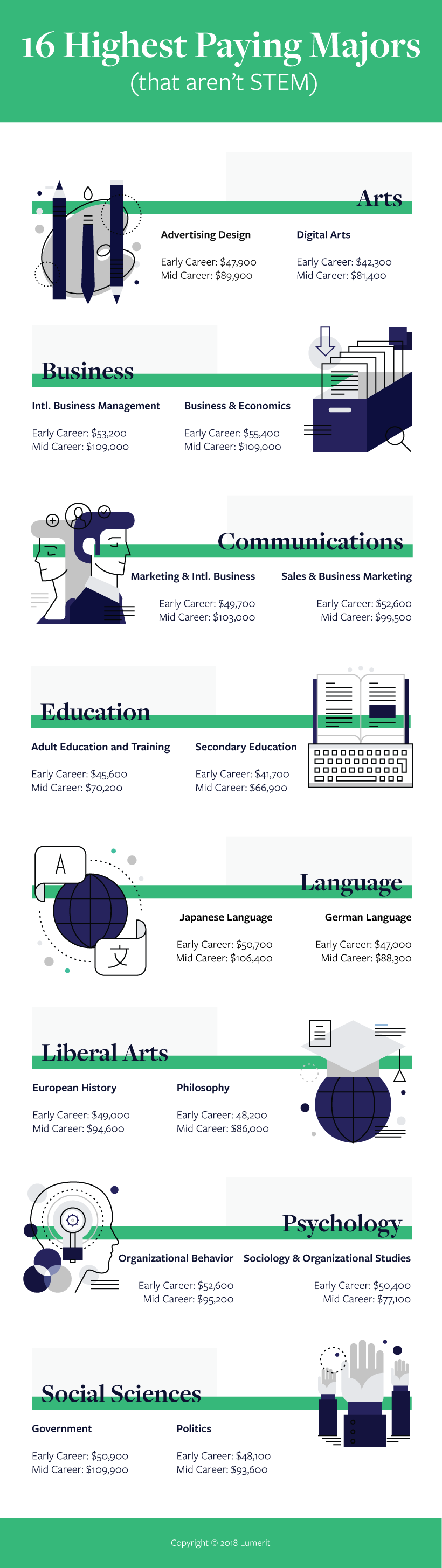

So if you’re struggling to make a degree decision that will satisfy your interests and your financial needs, here’s a list of the 16 highest paying degrees from each general field, according to PayScale.

Keep in mind, this list is nowhere near extensive, and there are many more high-paying degrees out there. No matter what your interests are, there are opportunities to thrive! So even if you aren’t a STEM genius, get out there and be your lovely self—people need what you can offer (and will pay you for whatever that is).

What are you waiting for? Go ahead and do your own research on the degrees that interest you. Determine your passions, calculate your degree’s return on investment, and get to work!

Before you know it, you’ll be working in a field that fuels your passions—without going broke.

Of course, if you’re serious about setting up a secure financial future post-graduation, you need to think about more than your degree. The average graduate pays $385 towards student loans every month. What if you could put that money toward your car, a wedding, or a house instead of throwing it to the debt monsters?

If you want financial security after college, you need to graduate debt free. Fortunately, that’s what we at Pearson help students do every single day. Click here to learn more about how you can graduate from your college without a single student loan with Accelerated Pathways.